Prepared to Improve Your Economic Scenario? Contact Us Now for Professional Therapy

Prepared to Improve Your Economic Scenario? Contact Us Now for Professional Therapy

Blog Article

Why Prioritizing Your Financial Wellness Includes Looking For Professional Credit Counselling Solutions for Sustainable Financial Obligation Alleviation

In a world where financial choices can significantly affect our present and future well-being, the significance of seeking specialist credit report therapy services can not be overemphasized. Attaining lasting debt alleviation involves greater than just paying; it needs a calculated approach that resolves the origin causes of monetary distress. By getting the assistance of experts in credit report therapy, individuals can gain useful insights, sources, and support to navigate their method towards economic stability. This method provides an alternative viewpoint on managing financial debt and developing a course in the direction of a protected financial future.

Advantages of Expert Credit Scores Coaching

Involving in expert credit history counseling can provide people with tailored financial methods to effectively handle and lower their financial obligation burden. By examining a customer's monetary scenario thoroughly, credit score therapists can create tailored financial debt management plans that fit the person's specific needs and goals.

Moreover, professional credit score therapy solutions frequently offer beneficial education on monetary proficiency and finance. Customers can obtain insights right into accountable spending routines, cost savings techniques, and lasting preparation for financial security. This expertise encourages individuals to make informed decisions regarding their funds and establish healthy economic habits for the future. Additionally, credit report counseling can provide emotional assistance and inspiration during difficult times, helping individuals remain motivated and devoted to their debt payment trip. On the whole, the benefits of expert credit score counseling extend past financial debt relief, aiding people construct a strong structure for lasting monetary well-being.

Recognizing Financial Debt Relief Options

When encountering overwhelming financial debt, people have to thoroughly evaluate and comprehend the various offered options for debt relief. One typical debt alleviation alternative is financial debt loan consolidation, where several debts are combined into a solitary funding with a lower interest price.

Bankruptcy is a more extreme financial obligation relief alternative that need to be considered as a last resort. It involves a legal process where debts are either restructured or forgiven under the security of the court. However, insolvency can have lasting repercussions on credit and financial future. Seeking specialist credit history counseling solutions can aid individuals analyze their monetary situation and determine one of the most suitable financial obligation alleviation alternative based upon their certain scenarios.

Developing a Personalized Financial Plan

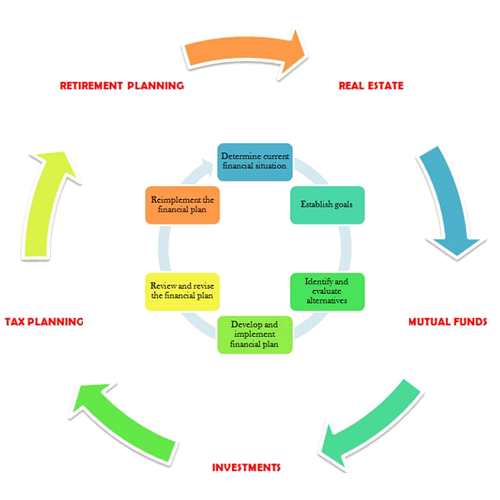

Thinking about the various financial obligation alleviation options available, it is crucial for individuals to develop a tailored monetary strategy customized to their certain circumstances. A personalized monetary strategy offers as a roadmap that details a clear course towards attaining monetary stability and freedom from financial obligation.

Following, setting particular and practical financial objectives is crucial. Frequently keeping an eye on and adjusting this spending plan as required is important to stay on track towards monetary goals.

In addition, seeking professional credit rating counseling services can provide important support and support in developing a personalized economic strategy. Credit score therapists can use skilled recommendations on budgeting, financial debt monitoring methods, and economic planning, aiding individuals make notified decisions to safeguard a steady monetary future.

Significance of Budgeting and Conserving

Reliable economic monitoring via budgeting and saving is fundamental to achieving long-lasting economic security and success. Budgeting allows people to track their income and costs, enabling them to focus on investing, determine areas for potential cost savings, and avoid unneeded debt. By developing a budget plan that lines up with their financial goals, individuals can properly prepare for the future, whether it be constructing an emergency situation fund, saving for retired life, or buying assets.

Saving is check my site just as important as it gives a monetary security net for unanticipated expenses and helps people function towards their monetary purposes. In budgeting, saving and essence are foundation methods that encourage people to take control of their finances, decrease financial stress, and work in the direction of achieving long-term economic safety.

Long-Term Financial Stability

Accomplishing lasting financial security is a calculated pursuit that necessitates cautious preparation and disciplined financial administration. To protect lasting financial health, individuals have to concentrate on developing a strong economic foundation that can stand up to unanticipated costs and economic changes. This foundation includes establishing a reserve, handling debt properly, and spending for the future.

One trick aspect of long-term economic stability is creating a sustainable budget plan that straightens with one's financial goals and concerns. By tracking earnings and expenses, people can ensure that they are living within their ways and saving for future needs. In addition, saving for retirement is essential in maintaining financial stability over the long-term. Planning for retired life very early index and consistently contributing to retirement accounts can help individuals secure their economic future.

Final Thought

Finally, seeking expert debt coaching solutions is essential for accomplishing lasting financial obligation relief and lasting economic stability. By understanding financial debt relief choices, creating a tailored monetary plan, and prioritizing budgeting and conserving, individuals can properly handle their financial resources and job towards a safe and secure monetary future. With the advice of debt counsellors, people can resource make enlightened decisions and take positive actions towards boosting their financial wellness.

An individualized economic plan offers as a roadmap that lays out a clear course towards achieving monetary security and freedom from financial debt. In essence, saving and budgeting are cornerstone practices that empower individuals to take control of their finances, minimize financial stress and anxiety, and job in the direction of attaining lasting financial safety.

To protect long-term financial well-being, individuals need to concentrate on developing a solid monetary foundation that can endure economic variations and unexpected expenses - contact us now. By leveraging professional advice, individuals can navigate monetary obstacles a lot more properly and function towards a sustainable debt relief plan that supports their long-lasting financial wellness

Report this page